The job of a private hire driver offers considerable freedom in terms of managing one's schedule and work. However, this independence comes with a major responsibility that is often overlooked due to the demands of everyday life: preparing for retirement.

Unlike traditional salaried employment, where contributions are deducted at source and managed by the employer, self-employed drivers are solely responsible for their social security arrangements. The legal choices you make today (company status, method of remuneration) will directly determine your future standard of living.

In a nutshell

Your retirement depends directly on your legal status and how carefully you manage your finances.

-

As a micro-enterprise, You only validate your quarters if you achieve a specific turnover (approximately €14,256 for four quarters in 2025). The time spent driving does not count; only the turnover received counts.

-

As a single-member private limited company, Beware of the dividend trap: if you do not pay yourself a salary, you do not contribute to your pension.

-

The EURL often offers the best balance between protection and cost for full-time use.

-

Regardless of the structure, a personal savings (PER, Immo) is essential to supplement the compulsory scheme.

Understanding the mechanics: Term grades vs. Points

To steer your strategy, you need to understand the engine under the bonnet. Your future retirement consists of two stages:

- The Basic Plan (Duration): It works by quarters. It determines when you will be able to retire at the full rate (without any reduction).

- Supplementary Scheme (Amount): It works by points. It determines how much you will receive. The more you contribute, the more points you accumulate.

The golden rule to remember: A validated quarter does not correspond to three months of work. It corresponds to the amount of contributions paid. You can work part-time all year round without validating your four quarters if your turnover is insufficient.

Choosing your status: The impact on your future

This is the most structuring decision. Each status has its own calculation logic. If necessary, we have a a complete guide to help you choose your status.

Micro-enterprises: The race for turnover

For micro-enterprises, the government applies a flat-rate allowance of £50% to your turnover to estimate your income. Your entitlements are calculated on this basis.

To validate a quarter, you must generate income equal to 150 times the hourly minimum wage. With the increase in the minimum wage, The threshold for validating your four quarters in 2025 is estimated at €14,256 in annual turnover..

- The danger: If you work as a private hire driver as a side job and declare €8,000 per year, you will only validate two quarters. In the long term, this creates «gaps» in your career that will push back your retirement age.

- The advice: Manage your monthly turnover to ensure you reach this critical threshold.

The SASU: The mirage of dividends

The SASU is popular, but it contains a formidable pitfall for retirement. The president is «assimilated to an employee», which offers excellent protection, but the charges are very high (approximately 80% of net salary).

To avoid these charges, many drivers choose not to pay themselves a salary and to take everything in dividends (taxed at the flat tax rate of 30%). Please note: Dividends do not generate ANY pension rights.. A year spent on «100% dividends» is a blank year for your retirement: 0 quarters validated, 0 points earned. This strategy is only viable if you are covered elsewhere (unemployment, other salaried employment).

EURL: The sensible choice for full-time employment

Often wrongly overlooked, the EURL (self-employed status) is mathematically very relevant for a career driver.

- The cost: Social security contributions are approximately 45% (compared to 80% for SASUs).

- The advantage: For the same total cost to the company, you can pay yourself a higher net salary than you would as a SASU employee, while still validating all your quarters and contributing to the supplementary pension scheme for self-employed workers.

Securing income through the ARPE framework

Income uncertainty is the enemy of retirement. Recent agreements by the ARPE (Authority for Social Relations on Employment Platforms) provide new visibility for 2025.

Two major guarantees now exist:

- Hourly guarantee of €30: Platforms must guarantee this minimum income per hour of activity.

- Minimum per trip: The minimum guaranteed threshold for the sector is €7.65 net for the driver (some applications may offer more, but this is the legal safety net).

Why does this matter for your retirement? These guarantees allow you to «mathematise» your year. To reach the validation threshold of four quarters (the famous €14,256), you theoretically need around 475 hours of guaranteed work during the year. Use these benchmarks to plan your weeks and avoid finding yourself «on the edge» at the end of the year.

Financial strategies: The «Third Pillar»

Even with a full career, the replacement rate (the difference between your final salary and your pension) will be low. It is essential to build up your own capital.

The PER (Retirement Savings Plan)

It is the ultimate tax tool. The amounts paid into a PER are deductible from your taxable profit.

- The tip: You reduce your taxes today while putting money aside for tomorrow.

- The bonus: The money is locked in until retirement, except in the case of purchasing your main residence. You can therefore use it to build up a tax-free deposit for a property.

Real estate and credit

Access to mortgage loans is more difficult for micro-enterprises (banks often apply a significant reduction to turnover) or SASUs with dividends (income considered unstable). Having accounting balance sheets (EURL or SASU) with a regular remuneration is the best way to reassure a banker and secure your future through property.

In 2025, preparing for retirement as a private hire driver does not necessarily mean paying the maximum amount of contributions, but rather paying the good expenses.

- Check that you exceed the threshold of 14 256 € of turnover if you are a micro-business.

- Avoid the «all dividends» approach in a SASU if it is your only source of income.

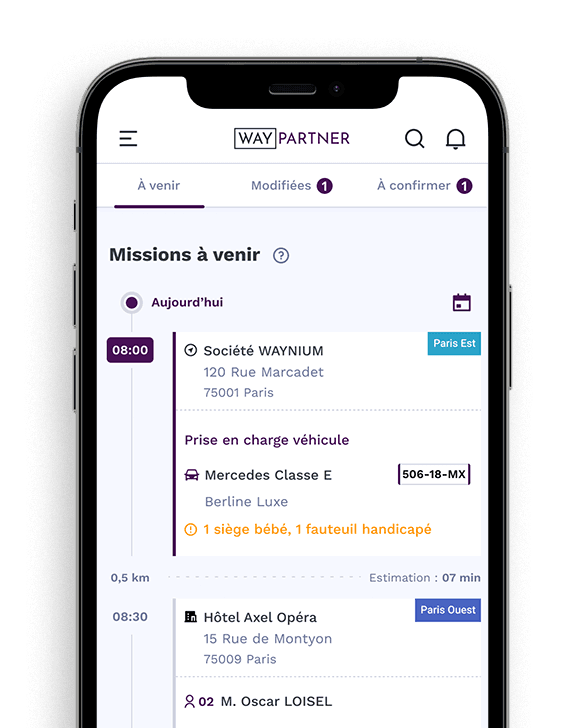

- Use management tools such as WAY-Partner to track your net turnover in real time and see where you stand in terms of your validation thresholds.

The freedom of the self-employed also includes the freedom to choose to protect themselves.

Glossary

Here are some useful terms to know and understand:

-

Flat-rate allowance: Automatic deduction of 50% applied by the administration to the turnover of micro-enterprise private hire vehicles to estimate taxable income.

-

ARPE: Authority for Social Relations on Employment Platforms. Organisation that sets the guaranteed minimum income (€30/hour, €7.65 net/trip).

-

Flat Tax: Flat tax of 30% on dividends. Please note: paying the flat tax does NOT entitle you to contribute to a pension scheme.

-

Self-employed worker: Social status of the manager of an EURL. It provides comprehensive social protection with lower costs than an SASU.