If you work as a VTC driver exclusively via an application, you don't have to worry about invoices: everything is managed by the platform. On the other hand, if you develop a private clientele and invoice your services directly, you are legally obliged to produce compliant invoices. This is not just an administrative formality: it provides legal protection and a guarantee of transparency for your customers.

The good news is that with the right tools and a few good practices, drawing up a compliant VTC 100 % invoice is quick and easy.

In a nutshell

For VTC drivers not using applications, invoices are compulsory. It must include a number of legal mentions (identity of the driver and the customer, description of the service, price excluding VAT, VAT, including VAT, date, unique invoice number, payment terms, insurance, CO₂ emissions, etc.). Forgetting to mention any of these may result in non-compliance.

Free invoicing software (Henrri, Zervant, Facture.net) helps you get started, but has its limitations. WAY Partner, designed for self-employed drivers, lets you manage everything in one place.

Who should submit a VTC invoice?

Drivers who only work via an application do not have to draw up an invoice: the platform takes care of this automatically.

However, as soon as you have a private clients (companies, hotels, regular private customers, etc.), invoicing is your responsibility. You must therefore produce your own invoices, in accordance with the French Commercial Code and the specific rules governing passenger transport.

Why is a compliant invoice essential?

An unavoidable legal obligation

An invoice is more than just a piece of paper: it's an accounting and legal document required by law. Without a valid invoice, you could face fines and difficulties in the event of a tax audit.

Protection for drivers and customers

In the event of a dispute, the invoice constitutes irrefutable proof: description of the service, agreed price, terms of payment. It protects both the customer against hidden charges and the driver against unfounded disputes.

Mandatory information on a VTC invoice

Identity of the driver (service provider)

- Name or company name.

- Address of registered office or place of business.

- SIREN or SIRET number.

- Legal form and share capital (if company).

- RCS number and town of registration (if company).

- Professional insurance details.

Customer identity

- Customer name and address.

- Intra-community VAT number if EU taxable customer.

Description of the service

- Precise nature of the service (errand, provisioning, airport journey, etc.).

- Date of service.

Financial details

- Amount excl.

- Applicable VAT rate (10 % for VTC passenger transport).

- VAT amount.

- Amount inclusive of all taxes.

Specific information on invoices

- Explicit mention "Invoice.

- A unique invoice number (continuous chronological sequence, without duplication).

- Date of issue of the invoice.

Terms of payment

- Payment terms.

- Penalties applicable in the event of delay.

- Minimum fixed indemnity of €40 in the event of recovery (compulsory for business customers).

Mention CO₂ obligatory

Since 2013, all passenger transport invoices have had to show the following information quantity of CO₂ emitted for the service. This figure must be calculated according to the ADEME scales. Most invoicing software packages include it automatically, so you don't have to calculate it manually.

Mistakes to avoid

- Using Excel or Word No tamper-proof numbering, risk of duplication and non-compliance in the event of a tax audit.

- Forgetting to include a compulsory statement Insurance, payment terms, CO₂... Every absence is a legal risk.

- Not organising your bills Without continuous numbering and archiving, it is impossible to justify your accounts.

What tools should I use to invoice a VTC?

Free software

- Henrri The software: free and comprehensive, compliant with legal obligations. Its limitations: cumbersome interface on mobile or tablet devices, tedious settings for certain information such as insurance or CO₂.

- Zervant Easy to use, with a limited free version. Suitable for beginners, but not specialised in transport.

- Facture.net (BPI France) reliable and institutional, but basic and not very user-friendly on mobile.

These solutions enable you to get started free of charge, but they are still general solutions and require a certain amount of manual rigour.

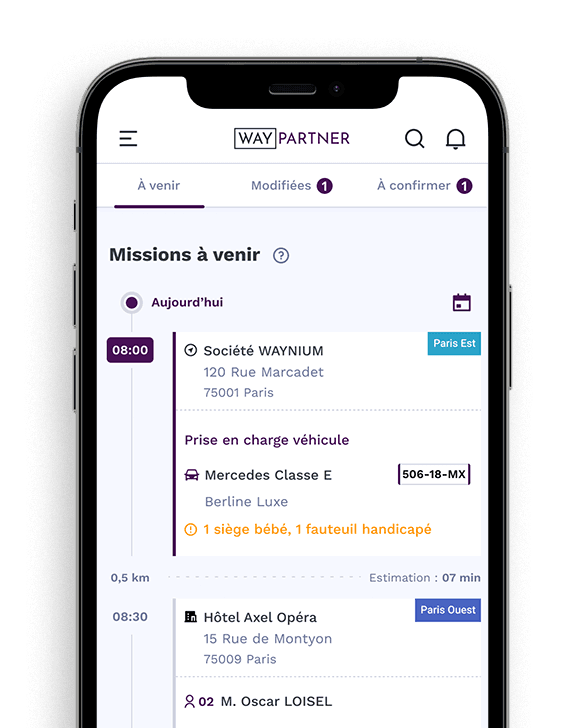

WAY Partner

WAY Partner goes further, because it has been designed specifically for self-employed drivers.

In addition to compliant invoicing (all legal notices automatically included, including the CO₂), the application offers a wide range of functions allowing you to manage your assignments, clients and regulatory documents all in one place. This saves a considerable amount of time and provides extra security to ensure that you remain compliant in all situations.

Solutions to avoid

Avoid Excel, Word or home-made invoices: they do not guarantee the continuous, tamper-proof numbering required by law. In the event of a tax audit, these documents are considered to be non-compliant.

Getting started with VTC billing

- Define your prices clearly before issuing your first invoices (basis excl. VAT, incl. VAT).

- Centralise your documents estimates, invoices, supporting documents.

- Use the right software This reduces errors and saves you time.

- Keep your invoices for at least 10 years (legal obligation).

Conclusion

Invoicing is not just an administrative constraint: it's a legal obligation, but also a guarantee of transparency and protection for you and your customers.

By complying with the mandatory information (including the CO₂ mention) and choosing the right software, you gain peace of mind and professionalism. Free solutions get you started, but a tool like WAY Partner, designed for VTCs, simplifies everything and ensures you are 100 % compliant.

Glossary

Here are some useful terms to know and understand:

SIREN (Système d'Identification du Répertoire des Entreprises) : Unique 9-digit number allocated to each company by INSEE.

SIRET (Système d'Identification du Répertoire des Établissements) : A unique 14-digit number that identifies a specific establishment of a company (includes the SIREN + an NIC code).

RCS (Registre du Commerce et des Sociétés) : Official register where traders and companies must register.

Excluding VAT Amount of the service before VAT.

All taxes included Final amount of the service including VAT.

VAT (Value Added Tax) Indirect tax on consumption, applied to most goods and services (10 % for VTC services).

Unique invoice number Mandatory sequential reference enabling each invoice to be identified continuously, without breaks or duplication.

Terms of payment Mandatory information indicating the payment deadline, late payment penalties and fixed compensation in the event of collection.

Mention CO₂ Mandatory indication of carbon dioxide emissions generated by the transport service.

Quote A written document that proposes a price before the service is provided and becomes contractual once accepted.

Invoice Accounting and legal document certifying that a service has been rendered and the price payable by the customer.

Professional insurance Compulsory cover for VTC drivers, guaranteeing that they will be covered in the event of a claim relating to their activity.