Accounting rumours are rife in the VTC world. «You can reclaim VAT on your saloon car», «Petrol is deductible at 100 %»... Be careful. While tax optimisation is a powerful way of boosting your profitability, it is subject to strict rules. A misinterpretation is unforgivable and tax reassessments are a reality.

The aim of this article is to set the record straight: what can you actually recover as a driver? How do you manage VAT on platform commissions? Here's the real guide to securing your cash flow.

In a nutshell

Contrary to popular belief, VAT on the purchase or hire of a traditional VTC saloon car is generally not recoverable, These cars are still classified as «Passenger Vehicles» (PV).

By the same token, neither is VAT on their maintenance.

The real levers for recovery lie elsewhere: electricity (100 % recoverable), tolls and, above all, platform commissions.

Beware, the Micro-entreprise scheme (basic exemption) is often a trap: you pay VAT on your expenses without being able to reclaim it, which increases your real costs, particularly on application commissions.

The choice of regime: Franchise or Real?

This is the basis of everything. Before talking about deductions, you need to understand your status.

The Basic Franchise trap (classic micro-enterprise)

If you don't charge VAT («VAT not applicable» on your invoices), you may think you're doing a good administrative job. In reality, for a VTC, this is often a losing calculation. And why is that? Because you pay VAT on all your expenses (fuel, car, repairs). without ever being able to get it back. This represents an additional «dry» cost of €20 % on your purchases. What's more, keep an eye on your thresholds: as soon as you exceed the higher threshold (€41,250 in 2025), you switch to VAT on the first day of the month. If you haven't anticipated this, 10 % of your turnover will disappear as a tax liability.

The strength of the Real (Simplified) Regime

This is often the route to optimisation. The mechanism is favourable:

- You collect 10 % VAT on your shopping (passenger transport).

- You deduct 20 % VAT on your eligible expenses (platform commissions, tolls, fees).

This differential (collecting little, deducting a lot) often makes it possible to drastically reduce the VAT payable, or even generate a VAT credit.

Buying a vehicle: The great disillusionment

This is the point where the most errors are made. Let's be clear: No, simply because you are a VTC does not mean you can reclaim VAT on your Peugeot 508 or Mercedes C-Class.

The tax rule is strict: vehicles in the «PC» (Private Passenger Vehicle) category on the registration document are excluded from the right to deduction. It doesn't matter if you use 100 % of it for work. The «Public Passenger Transport» exception, which is often cited, is interpreted very strictly by the authorities (it applies mainly to taxis with an ADS licence or coaches).

Rare exceptions : You can only reclaim the VAT if your vehicle is not a conventional car, for example :

- A large-capacity van (more than 8 seats + driver).

- A converted utility vehicle (rare in traditional VTC).

If you buy a standard saloon, assume that the VAT is lost. Don't budget for it to be reimbursed as part of your down payment, or you risk a tax adjustment of 20 % of the price of the car.

Maintenance and Repairs: «The accessory follows the main thing».»

In taxation, there is a golden rule: the tax treatment of incidental expenses follows that of the main asset. The logical consequence of the previous point is that your saloon car is not eligible for VAT deduction, all related maintenance costs are also excluded.

You cannot therefore not recover VAT on :

- Spare parts (tyres, brake pads, filters).

- Garage labour.

- Washing the vehicle.

This may seem unfair, but it is the strict application of the law for passenger vehicles.

Fuel and Energy: The electric shift pays off

If cars and maintenance are red zones, energy is an opportunity zone, especially if you have made the ecological transition.

Diesel and petrol: Equality at 80 %

The historic advantage of diesel is over. Today, whether you drive a passenger car on diesel or petrol (SP95, SP98, E10), the rule is the same: VAT is recoverable up to 80 %. The remaining 20 % are a burden for the company.

Electricity: The 100 % Winner

This is where optimisation comes into play. For electric vehicles, VAT on electricity is 100 % deductible. This applies to :

- Charging at public charging points (Superchargers, Ionity, etc.).

- Home charging (if you have a dedicated meter or an accurate reading via a connected terminal).

CNG and LPG also benefit from this rate of 100 %.

Platform Commissions: Beware the danger!

This is the most technical and riskiest dossier, especially for self-employed entrepreneurs.

The platforms are often based abroad (Netherlands, Estonia). They charge you a service fee (commission). Before tax. But be careful: «duty-free» does not mean «tax-free». As a professional in France, you must pay French VAT (20 %) on these commissions. This is the reverse charge.

- If you are on the Real Regime : This is a blank transaction. You declare the VAT due and immediately deduct it on the same line. Cash impact = €0.

- If you are a franchisee (Micro without VAT) : That's the catch. You have to declare this VAT to the government and pay it... but you can't reclaim it!

- Example: Uber takes 25 % in commission. With the VAT you have to pay to the government, this commission actually costs you 30 %.

This is a strong argument for switching to the actual scheme as soon as your turnover starts to rise.

Tolls and other charges: What has been approved?

Fortunately, there are still some current expenses 100 % deductible, whatever your vehicle:

- Motorway tolls : VAT is recoverable at 100 %. Tip: Get a professional electronic toll tag. Paper tickets can be lost or erased, but the monthly invoice for the badge is indisputable when it comes to inspections.

- Car parks : Only if it's a multi-storey car park (gated, underground) with an invoice showing VAT. On-street parking (parking meter) generally has no recoverable VAT.

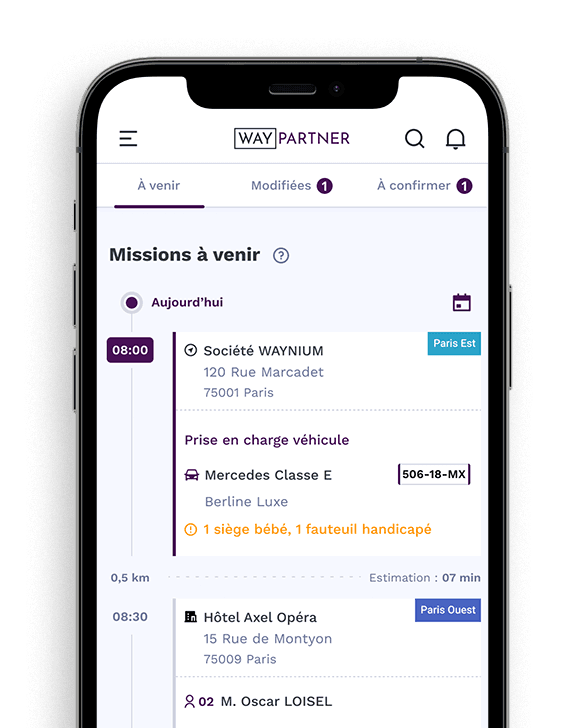

- Additional costs : VAT on your management software (such as WAY-Partner), your chartered accountant or your professional bank charges is fully deductible.

What is forbidden (don't tempt the devil)

- Costumes : Even if it's your work «uniform», the authorities consider that a suit can be worn in private life. No deduction is possible.

- Lunch : Unless you are invited by a client (business lunch), your personal lunch is not eligible for VAT recovery.

VTC taxation is a minefield for the uninitiated. While VAT on the purchase of vehicles is often a myth that should be forgotten, the actual tax regime remains a powerful tool for reclaiming VAT on platform commissions, tolls and electricity. Don't manage your business with a «wet finger». The difference in profitability between a driver who masters these rules and one who doesn't can amount to several thousand euros a year.

Glossary

Here are some useful terms to know and understand:

-

Reverse charge : Mechanism whereby the customer (you) pays the VAT instead of the foreign supplier (Uber/Bolt). Compulsory even for micro-entrepreneurs.

-

Passenger car: Mention on the vehicle registration document (J.1) designating a passenger vehicle. Excludes the right to deduct VAT.

-

Basic franchise : Tax system where no VAT is charged and nothing is recovered.

-

Régime Réel : Tax system under which actual VAT (collected on sales, deducted on purchases) is declared.

-

Subject : A person subject to VAT rules (whether they pay VAT or are exempt).